- Stage 1 of 4,000 m diamond drilling program has commenced at the Lemare spodumene pegmatite

- Undrilled spodumene pegmatite at least 200 m long grading up to 12 m @ 1.96% LI2O, as defined by surface channel sampling

September 14, 2016 – Montreal, Quebec – Critical Elements Corporation (“Critical Elements” or the “Company”) (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) and Platypus Minerals Ltd (ASX: PLP) (“Platypus”) are pleased to advise that a diamond drilling rig has arrived on site and commenced drilling over the weekend at the Lemare lithium project.

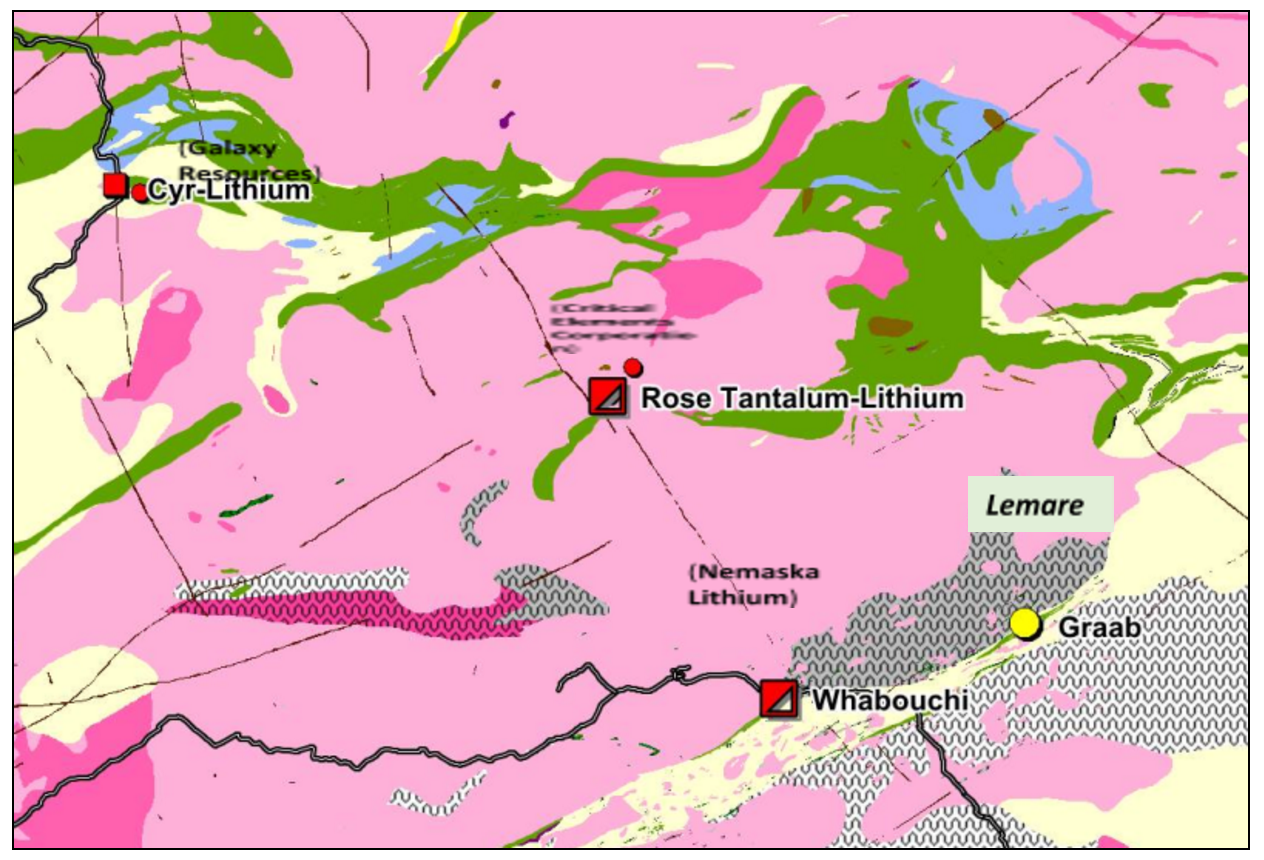

Lemare is located in the James Bay area of Quebec, Canada, in a district containing several advanced-stage lithium deposits (Figures 1 and 2).

Figure 1. Location of Lemare lithium project in Quebec, Canada.

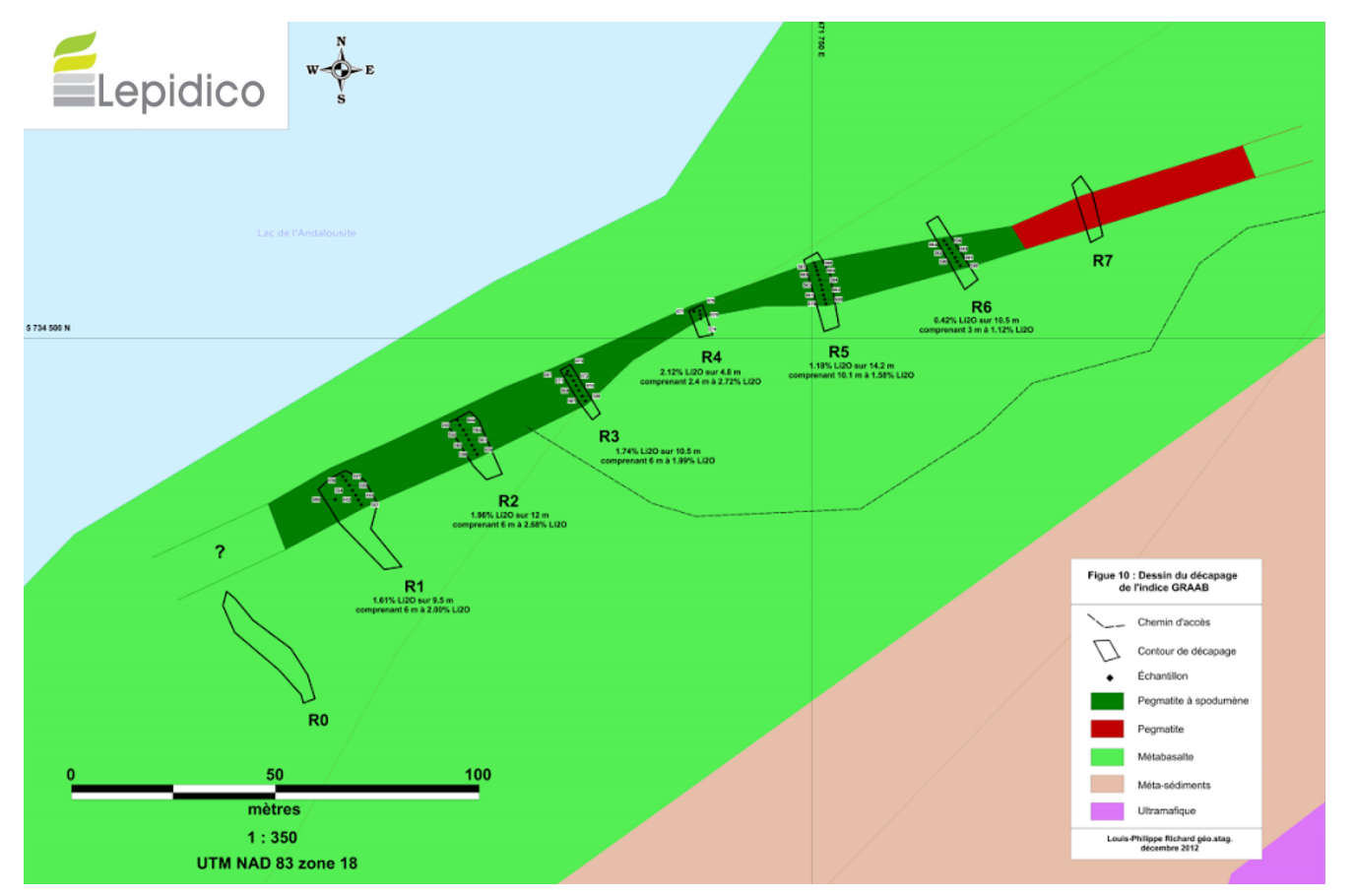

This work is part of a planned 4,000 m drilling program to investigate the mineralogy, dimensions and extent of the Lemare spodumene pegmatite with a view to defining a JORC Code-compliant resource at its completion. Stage 1 of the program will comprise mapping, prospecting, and approximately 2,000 m of diamond drilling (NQ core) across the known 200 m strike of the pegmatite and its immediate extensions. Initial channel sampling from six trenches cut across this pegmatite in 2012 by Monarques Resources returned up to 12 m @ 1.96% LI2O and averaged 10.25 m @ 1.44% LI2O (Figures 3-5; Table 1), as reported to the market on February 11, 2016. Stage 1 is expected to complete by late September- early October, with results anticipated in late October 2016. Stage 2 will be implemented after evaluation of Stage 1 results with the aim to complete by end November 2016.

Figure 2. Summary geology of the James Bay region, Quebec, Canada, showing similarity of geological setting of Whabouchi and Lemare on the northern edge of a belt of metamorphosed greenstones (green and yellow) wrapping around a zone of high-grade granulite and migmatite (dark grey). (After Quebec Ministry of Energy and Natural Resources, 2016). Lemare sits 25 km ENE of Whabouchi.

|

|

|

The Lemare project is some 70 km2 in area and is secured by an option agreement (“Lemare Option”) entered into on February 11, 2016 by the Platypus’ wholly owned subsidiary Lepidico Ltd (“Lepidico”) and Critical Elements Corporation. Full details were reported to the market on February 11, 2016. Platypus is earning up to 75% of the Lemare project. As part of the agreed earn-in terms, Platypus has issued to Critical Elements $500,000 worth of Platypus shares (being 18,514,939 shares). To complete the initial earn of a 50% interest in the project, Platypus is to fund exploration expenditure of $800,000 by December 31, 2016, and a further $1.2 million by December 31, 2017.

Platypus can then proceed to earn an additional 25% interest in Lemare by paying to Critical Elements $2,500,000 and delivering a definitive feasibility study and environmental study by June 30, 2020.

Figure 5. Trenching program at Lemare showing the six trenches channel sampled as per Table 1 (after Monarques Resources Inc., 2012).

Table 1. Channel sampling results from Lemare (Monarques Resources Inc.)

| Channel | Grade Li2O % | Length (metres) |

| LEM(Li)-12-R1 | 1.61% | 9.5 m |

| including | 2.00% | 6.0 m |

| LEM(Li)-12-R2 | 1.96% | 12.0 m |

| including | 2.68% | 6.0 m |

| LEM(Li)-12-R3 | 1.74% | 10.5 m |

| LEM(Li)-12-R4 | 2.12% | 4.8 m |

| LEM(Li)-12-R5 | 1.18% | 14.2 m |

| including | 1.58% | 10.1 m |

| LEM(Li)-12-R6 | 0.42% | 10.5 m |

| including | 1.12% | 3.0 m |

| AVERAGE | 1.44% | 10.25 m |

Jean-Sébastien Lavallée (OGQ #773), geologist, shareholder and President and Chief Executive Officer of the Company and a Qualified Person under NI 43-101, has reviewed and approved the technical content of this release.

About Critical Elements Corporation

A recent financial analysis (Technical Report and Preliminary Economic Assessment (PEA) on the Rose lithium-Tantalum Project, Genivar, December 2011) of the Rose project, 100% owned by Critical Elements, based on price forecasts of US$260/kg ($118/lb) for Ta2O5 contained in a tantalite concentrate and US$6,000/t for lithium carbonate (Li2CO3) showed an estimated after-tax Internal Rate of Return (IRR) of 25% for the Rose project, with an estimated Net Present Value (NPV) of CA$279 million at an 8% discount rate. The payback period is estimated at 4.1 years. The pre-tax IRR is estimated at 33% and the NPV at $488 million at a discount rate of 8%. (Mineral resources are not mineral reserves and do not have demonstrated economic viability). (The preliminary economic assessment is preliminary in nature). (See press release dated November 21, 2011.)

The conclusions of the PEA indicate the operation would support a production rate of 26,606 tons of high purity (99.9% battery grade) Li2CO3 and 206,670 pounds of Ta2O5 per year over a 17-year mine life.

The project hosts a current Indicated resource of 26.5 million tonnes of 1.30% LI2O Eq. or 0.98% LI2O and 163 ppm Ta2O5 and an Inferred resource of 10.7 million tonnes of 1.14% LI2O Eq. or 0.86% LI2O and 145 ppm Ta2O5.

FOR MORE INFORMATION:

Jean-Sébastien Lavallée, P.Geo.

President and Chief Executive Officer

819-354-5146

www.cecorp.ca

Investor Relations:

Paradox Public Relations

514-341-0408

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.