![]() Download PDF Version | View documents on Sedar

Download PDF Version | View documents on Sedar

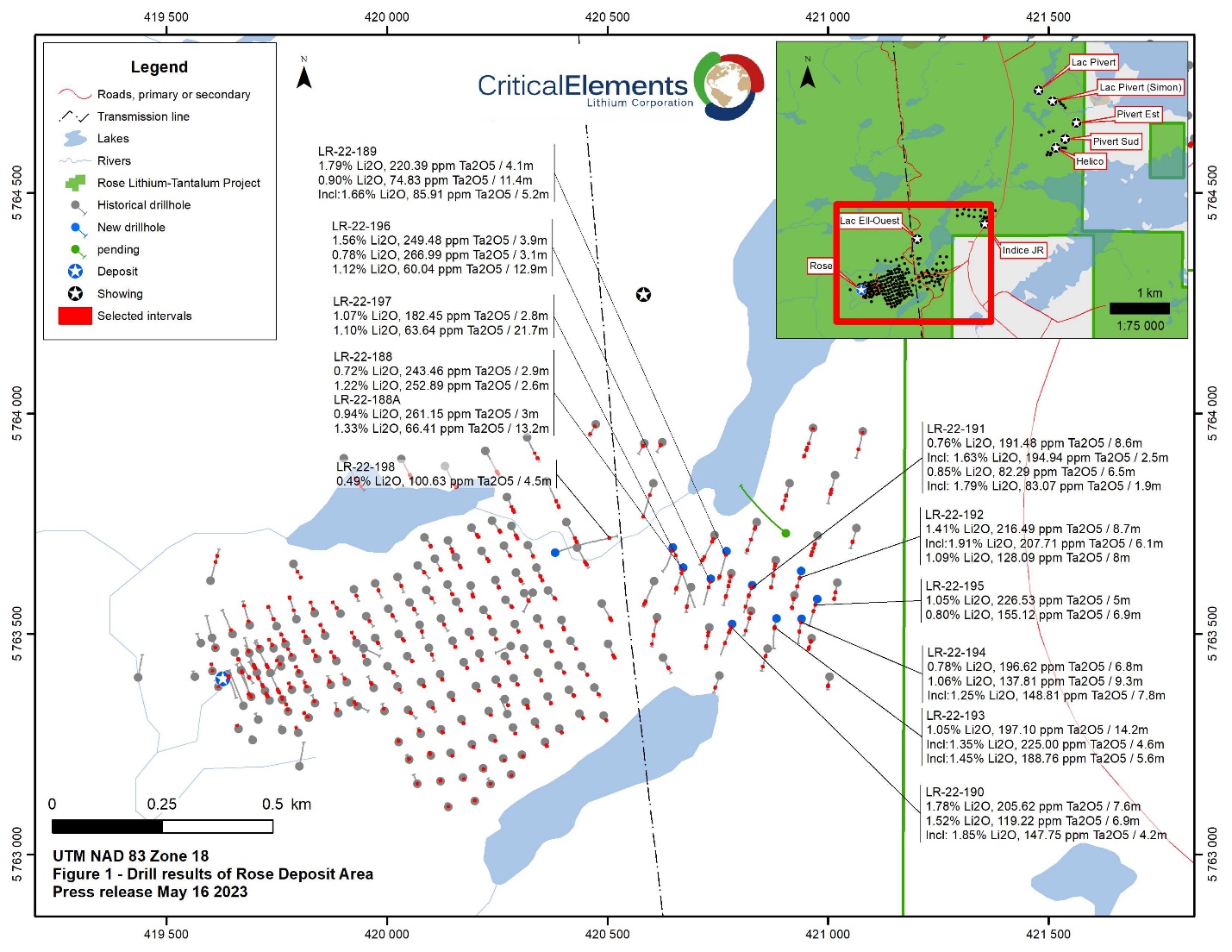

May 16th, 2023 – Montréal, Québec – Critical Elements Lithium Corporation (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) (“Critical Elements” or the “Corporation“) is pleased to report results from the recent infill drill program completed on the Rose Lithium-Tantalum Project (“Rose Project”, “Rose” or “Project”). The Corporation completed a 2,382-meter drill program, encompassing thirteen drillholes. The program was designed to collect more geotechnical information for the optimization of mining engineering and at the same time to better tighten the drilling resolution in the eastern part of the deposit. The best intercepts are presented in Table 1 and Figure 1.

Selected drill intersection highlights include:

- LR-22-188A: 1.33% Li2O and 66.41ppm Ta2O5 over 13.20 m

- LR-22-189: 1.79% Li2O and 220.39 ppm Ta2O5 over 4.10 m and 1.66% Li2O and 85.91 ppm Ta2O5 over 5.20 m

- LR-22-190: 1.78% Li2O and 205.62 ppm Ta2O5 over 7.60 m and 1.52% Li2O and 119.22 ppm Ta2O5 over 6.90 m

- LR-22-192: 1.41% Li2O and 216.49 ppm Ta2O5 over 8.70 m

- LR-22-193: 1.05% Li2O and 197.10 ppm Ta2O5 over 14.20 m

- LR-22-194: 1.06% Li2O and 137.81 ppm Ta2O5 over 9.30 m

- LR-22-195: 1.05% Li2O and 226.53 ppm Ta2O5 over 5.00 m

- LR-22-196: 1.12% Li2O and 60.04 ppm Ta2O5 over 12.90 m

- LR-22-197: 1.10% Li2O and 63.64 ppm Ta2O5 over 21.70 m

Table 1: Rose Project – Summary of lithium results from the recent drilling program

| Hole # | UTM NAD 83 ZN18 | Length | Azimuth | Dip | Number | From | To | Interval * | Li2O | Ta2O5 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Easting | Northing | (m) | (°) | (°) | of samples | (m) | (m) | (m) | (%) | (ppm) | |

| LR-22-188 | 420671 | 5763650 | 81.00 | 195 | -80 | 10 | 25.10 | 28.00 | 2.90 | 0.72 | 243.46 |

| 36.80 | 39.40 | 2.60 | 1.22 | 252.89 | |||||||

| LR-22-188A | 420671 | 5763650 | 180.00 | 195 | -70 | 34 | 33.70 | 36.70 | 3.00 | 0.94 | 261.15 |

| 133.40 | 146.60 | 13.20 | 1.33 | 66.41 | |||||||

| LR-22-189 | 420770 | 5763687 | 180.00 | 195 | -70 | 37 | 22.60 | 26.70 | 4.10 | 1.79 | 220.39 |

| 155.10 | 166.50 | 11.40 | 0.90 | 74.83 | |||||||

| including | 160.20 | 165.40 | 5.20 | 1.66 | 85.91 | ||||||

| LR-22-190 | 420782 | 5763522 | 210.00 | 200 | -70 | 32 | 51.80 | 59.40 | 7.60 | 1.78 | 205.62 |

| 126.70 | 133.60 | 6.90 | 1.52 | 119.22 | |||||||

| including | 129.40 | 133.60 | 4.20 | 1.85 | 147.75 | ||||||

| LR-22-191 | 420828 | 5763610 | 192.00 | 200 | -70 | 37 | 71.40 | 80.00 | 8.60 | 0.76 | 191.48 |

| including | 73.80 | 76.30 | 2.50 | 1.63 | 194.94 | ||||||

| 148.00 | 154.50 | 6.50 | 0.85 | 82.29 | |||||||

| including | 149.10 | 151.00 | 1.90 | 1.79 | 83.07 | ||||||

| LR-22-192 | 420939 | 5763642 | 183.00 | 195 | -70 | 42.00 | 50.70 | 8.70 | 1.41 | 216.49 | |

| including | 43.90 | 50.00 | 6.10 | 1.91 | 207.71 | ||||||

| 101.00 | 109.00 | 8.00 | 1.09 | 128.09 | |||||||

| LR-22-193 | 420883 | 5763535 | 171.00 | 195 | -70 | 43 | 51.90 | 66.10 | 14.20 | 1.05 | 197.10 |

| including | 53.80 | 58.40 | 4.60 | 1.35 | 225.00 | ||||||

| including | 59.10 | 64.70 | 5.60 | 1.45 | 188.76 | ||||||

| LR-22-194 | 420940 | 5763534 | 150.00 | 195 | -70 | 24 | 20.90 | 27.70 | 6.80 | 0.78 | 196.62 |

| 76.50 | 85.80 | 9.30 | 1.06 | 137.81 | |||||||

| including | 77.40 | 85.20 | 7.80 | 1.25 | 148.81 | ||||||

| LR-22-195 | 420975 | 5763579 | 180.00 | 195 | -70 | 27 | 37.30 | 42.30 | 5.00 | 1.05 | 226.53 |

| 78.40 | 85.30 | 6.90 | 0.80 | 155.12 | |||||||

| LR-22-196 | 420734 | 5763625 | 180.00 | 195 | -70 | 58 | 19.60 | 23.50 | 3.90 | 1.56 | 249.48 |

| 57.40 | 60.50 | 3.10 | 0.78 | 266.99 | |||||||

| 138.00 | 150.90 | 12.90 | 1.12 | 60.04 | |||||||

| LR-22-197 | 420648 | 5763696 | 225.00 | 160 | -50 | 49 | 27.70 | 30.50 | 2.80 | 1.07 | 182.45 |

| 159.50 | 181.20 | 21.70 | 1.10 | 63.64 | |||||||

| LR-22-198 | 420381 | 5763684 | 225.00 | 70 | -52 | 19 | 195.30 | 199.80 | 4.50 | 0.49 | 100.63 |

| LR-22-199 | 420904 | 5763728 | 225.00 | 310 | -53 | 84 | Pending results | ||||

This phase of drilling has been valuable in providing more geotechnical data that will be incorporated into the final mine plan. The tightened drill resolution has provided greater confidence in the resource block model on the eastern portion of the Rose deposit. Additional drilling is planned later this year to test the northern extension of the deposit, as well as potential satellite spodumene-bearing pegmatites within 10 km.

A 5,554-meter, 31-hole winter drill program was conducted on the Lemare zone and data is being compiled. Critical Elements intends to pursue further work on Lemare over the summer with surface mapping and a sampling program follow by drilling. Lemare is well-situated within 3 km of road access and is an excellent candidate for initial technical studies.

Quality assurance/quality control

Quality assurance and quality control procedures were implemented to ensure best practices in sampling and analysis of the core samples. The drill core was logged and then split, with one-half sent for assay and the other retained in the core box as a witness sample. Duplicates, standards, and blanks were regularly inserted into the sample stream. The core samples were delivered, in secure tagged bags, directly to the ALS Minerals laboratory facility in Val-d’Or, Quebec. The samples are weighed and identified prior to sample preparation. The samples are crushed to 70% minus 2 mm, then separated and pulverized to 85% passing 75 μm. All samples are analyzed using sodium peroxide fusion ME-MS-89L, with full analysis for 52 elements. Value over 25,000 ppm Li were re-assays using Li-ICP-82b and value over 2,500 ppm Ta2O5 were re-assays using Ta-XRF10.

Rose Lithium-Tantalum Project update:

The Corporation is pleased to report that the front-end engineering design (“FEED”) and value engineering studies for the process plant and associated infrastructure were completed during the first quarter of 2023. Bumigeme Inc. performed a gap analysis of the process plant, focusing on design review, optimization, and risk mitigation for any potential issues with the process flowsheet developed during the feasibility study. During the same period, WSP completed the FEED study for the infrastructure, surface water management, mine water treatment plant, installation of the final effluent, main electrical station, 25 kV distribution, utilities, service buildings and mining support facilities. Bumigeme Inc. and WSP completed these mandates on schedule and within budget.

On completion of the gap analysis, Bumigeme Inc., BBA, WSP and other specialists in planning and industrial processes commenced a new study with the aim of improving and freezing the 3D model layout for all equipment and defining data sheets to fulfill long lead time equipment orders. WSP-Golder was mandated to complete the detailed engineering design of the co-disposal facility for the filtered mill tailings and waste rock from the open pit. Over 40% of WSP-Golder’s mandate has been completed with completion expected by the end of Q2 2023. Engineering work includes hazard classification, laboratory testing of tailings, staging and placement, water management design, hydrogeological modeling, seepage collection, stability assessment and an instrumented monitoring plan.

Furthermore, the Corporation announces the awarding of the detailed engineering mandate for the process plant and the main electrical station to the BBA team. It is important to note that BBA is very familiar with the Rose lithium and tantalum concentrator project. They carried out several audit and optimization mandates on our project originally developed by Bumigeme Inc. and WSP. Thus, BBA will be able to ensure a smooth transition to the execution of the detailed engineering phases. In addition, BBA has extensive multidisciplinary experience on previous mining projects, including several projects in northern Quebec. BBA will be an important player in the success of our project.

The Corporation is also proud to announce that all detailed engineering mandates have now been granted to our partners WSP, BBA and InnovExplo. Critical Elements has all the necessary funds to complete the detailed engineering phase. Overall engineering is progressing well, and we are over 35% complete. Key engineering deliverables will be completed during the summer period to allow, if project financing and building permits are in place, to begin deforestation and initial preparation work by the end of the year.

Project Financing update:

As noted earlier this year (see press release dated February 1st, 2023) Critical Elements commenced a formal process to receive and analyze multiple expressions of interest in participating in the financing and development of the Rose Project. This process has advanced such that multiple parties have provided comprehensive, non-binding expressions of interest to participate that compare favourably to the initial capital estimate outlined in the Project’s 2022 Feasibility Study (see press release dated June 13, 2022). Critical Elements will continue to progress discussions with the leading parties, subject to negotiating acceptable financing terms and conditions, as well as satisfactory due diligence and entering into the required definitive documentation. Updates on this matter will be provided as appropriate.

The Corporation’s long-term strategy of avoiding Memorandum of Understandings for offtake arrangements leaves the Rose Project’s planned production unencumbered in a tight market for spodumene concentrate, both for chemical conversion for the burgeoning EV battery market and for the higher margin glass and ceramics industry. Despite the recent correction in spot lithium markets, underlying market demand remains robust in the face of supply-side sovereign, financial, and execution risks over the next several years. Conventional lithium concentrate projects in a top tier mining jurisdiction with major environmental permits and an existing Impact and Benefits Agreement remain exceedingly rare.

Québec is recognized as a top mining jurisdiction with access to excellent infrastructure, as well as strong financial and human capital. This makes the Rose Project’s metallurgically attractive spodumene concentrate highly desirable. Management is actively engaged in identifying the optimal strategic partner or partners to maximize benefits for all the Corporation’s stakeholders, but at this time, there can be no guarantees as to the timing and outcome of this process.

Federal Budget:

Critical Elements expresses its satisfaction that the Government of Canada has acknowledged the significance of clean technology manufacturing by introducing a 30% investment tax credit (ITC) in its 2023 Budget, which can be refunded. The Corporation believes that a significant portion of the equipment included in the 2022 Feasibility Study capital expenditures will be qualified for the newly introduced federal tax credit.

Qualified persons

Yves Perron, Eng. MBA, Vice-President Engineering, Construction and Reliability and Paul Bonneville, Eng, are the qualified persons that have reviewed and approved the technical contents of this news release on behalf of the Corporation.

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly owned, high purity Rose lithium project in Québec, the Corporation’s first lithium project to be advanced within a land portfolio of over 1,000 square kilometers. On June 13th, 2022, the Corporation announced results of a feasibility study on Rose for the production of spodumene concentrate. The after-tax internal rate of return for the Project is estimated at 82.4%, with an estimated after-tax net present value of US$1.9 B at an 8% discount rate. In the Corporation’s view, Québec is strategically well-positioned for US and EU markets and boasts good infrastructure including a low-cost, low-carbon power grid featuring 94% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government and also received the Certificate of Authorization pursuant to section 164 of Québec’s Environment Quality Act from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parks.

For further information, please contact:

Patrick Laperrière

Director of Investor Relations and Corporate Development

514-817-1119

www.cecorp.ca

Jean-Sébastien Lavallée, P. Géo.

Chief Executive Officer

819-354-5146

www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement concerning forward-looking statements

This news release contains “forward-looking information” within the meaning of Canadian Securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “scheduled”, “anticipates”, “expects” or “does not expect”, “is expected”, “scheduled”, “targeted”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information contained herein include, without limitation, statements relating to the results and completion of the 2023 exploration program, the permitting process, the results and outcome of the Front-End Engineering Design Study, eligibility of equipment required for the Rose Project to the 30% investment tax credit (ITC) announced by the Federal government in its last budget, as well as the outcome of the formal process launched by the Corporation in connection with the Project financing. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Although Critical Elements has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking information include, but are not limited to: final and complete results of the Corporation’s 2023 exploration program, the final outcome of the permitting process and the Corporation’s ability to meet all conditions imposed thereunder, the final results of the Front-End Engineering Design Study and its effects on the development of the Rose Project, the formal process launched in connection with the Project financing not producing the anticipated and expected results, the criteria for eligibility to the 30% investment tax credit (ITC) announced in the last federal budget not being those expected, as well as those risk factors set out in the Corporation’s Management Discussion and Analysis for its most recent quarter ended February 28, 2023 and other disclosure documents available under the Corporation’s SEDAR profile. Forward-looking information contained herein is made as of the date of this news release and Critical Elements disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws