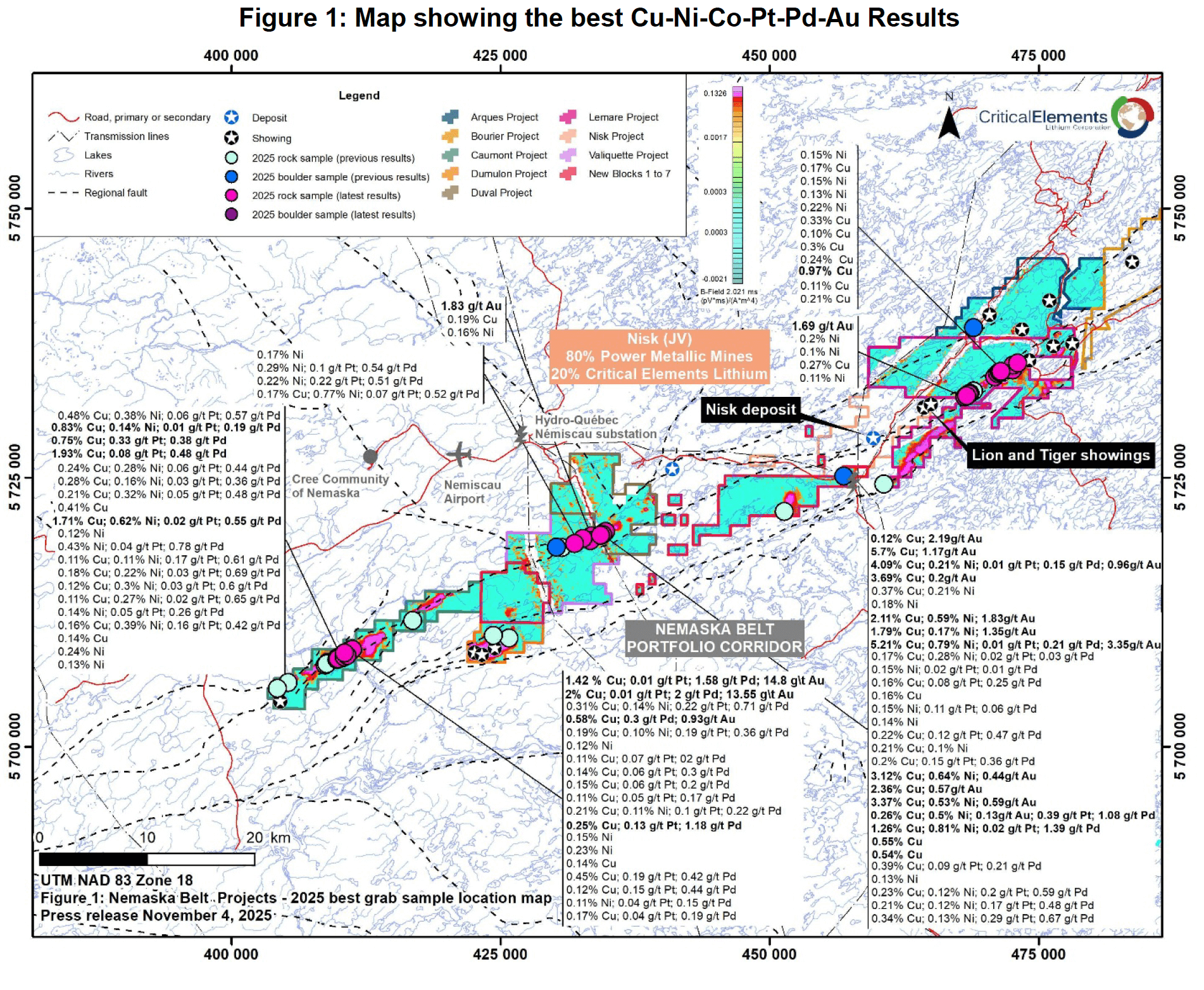

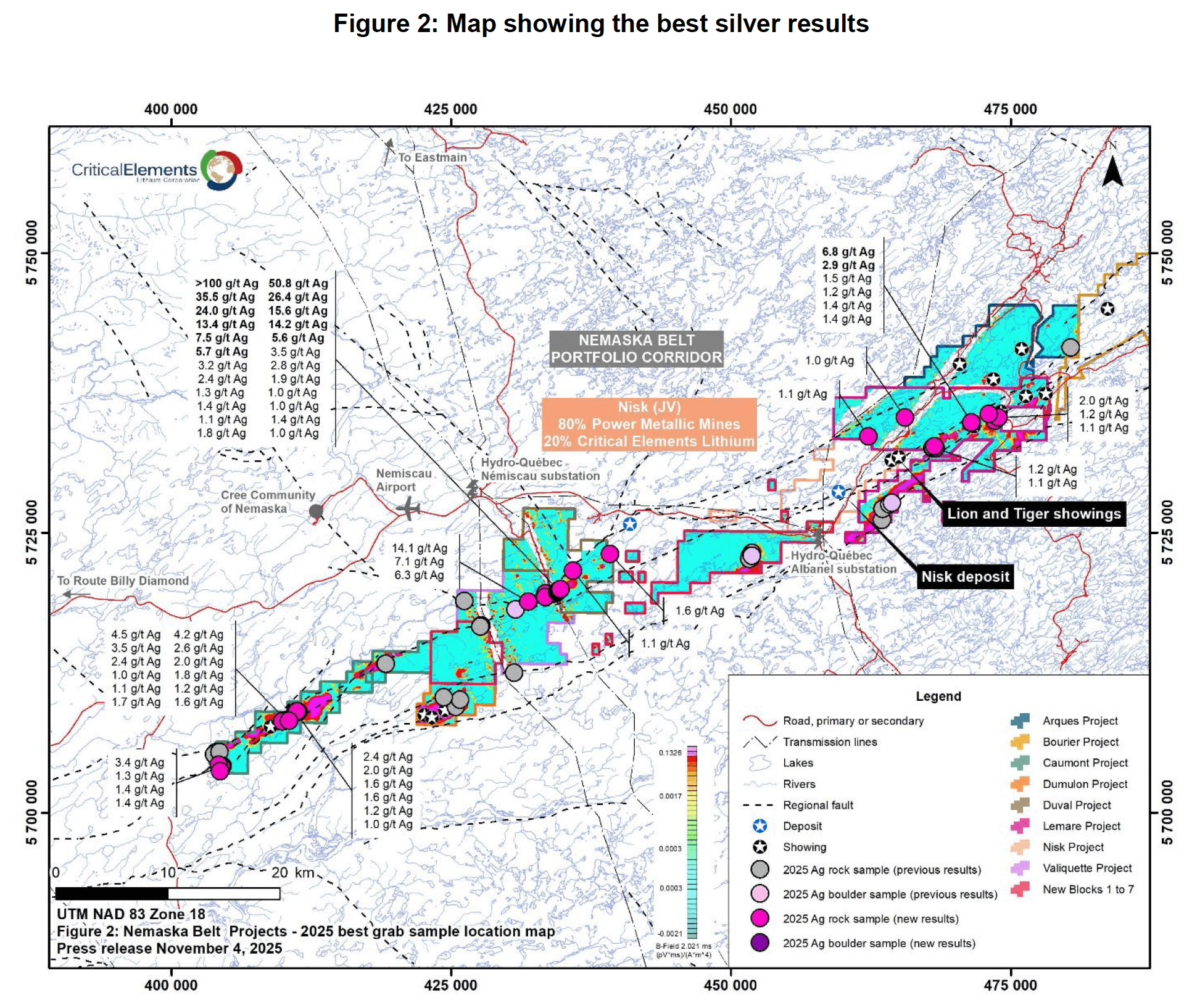

November 4th, 2025 – MONTRÉAL, QUÉBEC – Critical Elements Lithium Corporation (TSX-V: CRE) (US OTCQX: CRECF) (FSE: F12) (“Critical Elements” or the “Corporation”) is pleased to announce the latest results from the 2025 summer exploration program completed on Critical Elements’ 100%-owned Nemaska Belt properties group, in the Eeyou Istchee region of Québec (Figure 1).

An important helicopter-borne electromagnetic VTEM plus time-domain system (“VTEM”) survey covering the Nemaska Belt properties was designed to provide data incremental to the high-resolution magnetic survey completed in 2021. These datasets aided the exploration surface program targeting potentially economic mineralization, including high-grade nickel-copper-PGE and lithium-bearing spodumene.

Interest in high-grade nickel-copper-PGE mineralization in the region has increased with the exploration success of Power Metallic Mines Inc. (“Power Metallic”), formerly Chilean Metals Inc. Critical Elements optioned the Nisk Property to Power Metallic in 2020 (see press release dated December 23, 2020). Following the exercise of the option agreement by Power Metallic on the Property hosting the Ni-Cu-PGE Nisk deposit and the new polymetallic Lion discovery, Critical Elements retains a non-dilutive interest of 20% until a definitive feasibility study regarding extraction and production activities is completed on the Nisk property. Critical Elements also held just over 10 million shares of Power Metallic as of May 31, 2025 (Condensed Interim Financial Statements for the nine-month period ending May 31, 2025).

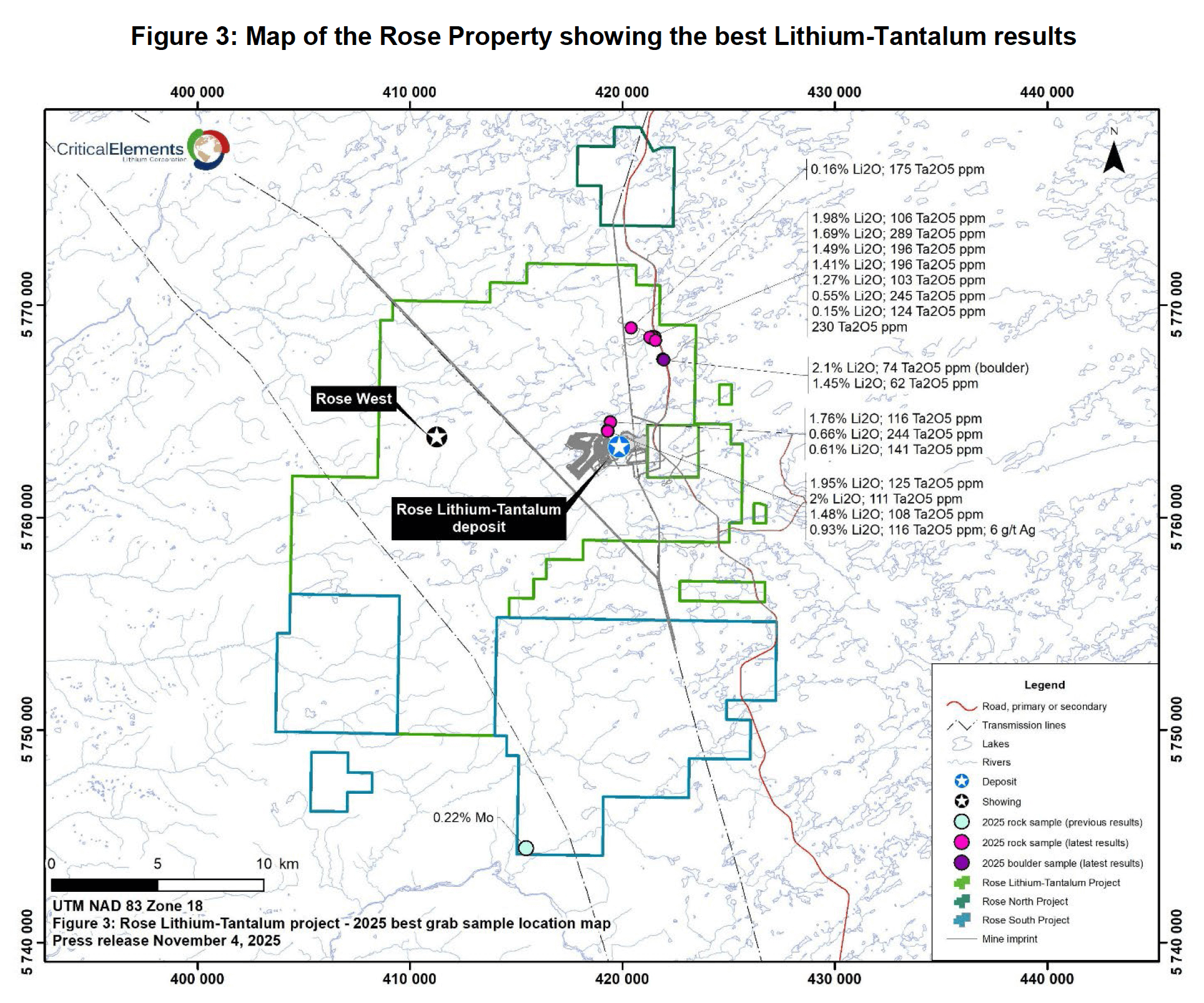

“We are very excited by these new preliminary exploration results on the Nemaska Belt properties and the upcoming winter drill program to test the resultant targets”, noted CEO Jean-Sébastien Lavallée. “We are also excited to resume expansion drilling this winter on the Rose West lithium discovery within 10 km of our flagship Rose lithium project. These near-term exploration initiatives should demonstrate the significant potential of our extensive land package in Eeyou Istchee, Québec, one of the leading mining jurisdictions globally. Our long-term objective, however, remains to develop the Rose project, one of the most advanced hard rock lithium projects in North America. To this end, discussions with potential strategic partners have continued fruitfully as the lithium market appears to be reemerging from its hiatus.”

Mineralized Zones

During the 2025 summer exploration program, multiple mineralized zones were identified through rock sampling in areas coinciding with electromagnetic anomalies (VTEM conductors). The mineralization is dominated by pyrrhotite and pyrite (iron sulfides) with chalcopyrite (copper sulfide) and/or pentlandite (iron-nickel sulfide). Surface exploration confirmed historical showings and identified newly prospective areas. The exploration program was designed to maximize geochemical coverage and assist in defining targets for future drill testing (Table 1, 2 and 3, Figures 1, 2 and 3).

The best new results from the 452 rock samples that were still pending (Table 1 and 3) from the 1,091 rock samples collected during the summer campaign are shown below (Table 2 for previously announced results) (see press release dated September 11, 2025). Of these samples:

- 58 grab samples grading 0.1% or above copper, with values up to 5.70% copper

- 50 grab samples grading 0.1% or above nickel, with values up to 0.82% nickel

- 6 grab samples grading 0.05% or above cobalt, with values up to 0.17% cobalt

- 20 grab samples grading 0.1 g/t or above platinum, with value up to 0.39 g/t platinum

- 56 grab samples grading 0.1 g/t or above palladium, with values up to 2.0 g/t palladium

- 10 grab samples grading above 1.0 g/t gold, with values up to 14.80 g/t gold

- 70 grab samples grading 1.0 g/t or above silver, with values up to over 100 g/t silver

- 15 grab samples grading above 0.5% Li2O, with values up to 2.10% Li2O

Grab samples are selective by nature, unlikely to represent average grades, and may not represent true underlying mineralization.

Table 1: Best 2025 New Samples Cu-Ni-Co-Pt-Pd-Au-Ag results

| Sample # | Easting UTM | Northing UTM | Cu % | Ni % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t |

|---|---|---|---|---|---|---|---|---|---|

| G437173 | 411101 | 5708872 | 0,19* | 0,10* | 0,02* | 0,19 | 0,36 | 0,006 | 0,8* |

| G437175 | 411118 | 5708958 | 0,08* | 0,03* | 0,01* | 0,06 | 0,14 | 0,005 | 0,0* |

| G437176 | 411122 | 5708961 | 0,11* | 0,05* | 0,01* | 0,07 | 0,20 | 0,005 | 0,0* |

| G437177 | 411124 | 5708964 | 0,14* | 0,08* | 0,02* | 0,06 | 0,30 | 0,000 | 0,0* |

| G437178 | 411126 | 5708964 | 0,15* | 0,07* | 0,01* | 0,06 | 0,20 | 0,006 | 0,6* |

| G437179 | 411129 | 5708967 | 0,11* | 0,04* | 0,01* | 0,05 | 0,17 | 0,000 | 0,5* |

| G437180 | 411134 | 5708971 | 0,21* | 0,11* | 0,02* | 0,10 | 0,22 | 0,006 | 0,0* |

| G437181 | 411246 | 5709040 | 0,25* | 0,08* | 0,01* | 0,13 | 1,18 | 0,007 | 0,6* |

| G437183 | 411248 | 5709041 | 0,01* | 0,09* | 0,01* | 0,05 | 0,17 | 0,011 | 0,0* |

| G437184 | 411248 | 5709041 | 2,00* | 0,03* | 0,01* | 0,00 | 2,00 | 13,55 | 13,2* |

| G437185 | 411248 | 5709041 | 1,42* | 0,03* | 0,01* | 0,00 | 1,58 | 14,80 | 8,5* |

| G437186 | 411267 | 5709043 | 0,08* | 0,03* | 0,01* | 0,06 | 0,12 | 0,019 | 0,0* |

| G437214 | 430608 | 5712528 | 0,04 | 0,02 | 0,00 | N/A | N/A | 0,009 | 2,7 |

| G437231 | 468196 | 5732546 | 0,00* | 0,00* | 0,00* | N/A | N/A | 1,69 | 0,9* |

| G437482 | 468495 | 5732739 | 0,00 | 0,20 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437522 | 470911 | 5734341 | 0,01 | 0,13 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437559 | 404598 | 5704200 | 0,01 | 0,00 | 0,01 | 0,00 | 0,00 | 0,00 | 1,3 |

| G437563 | 404496 | 5704124 | 0,03 | 0,01 | 0,01 | 0,00 | 0,00 | 0,00 | 3,4 |

| G437705 | 434370 | 5719636 | 0,37 | 0,21 | 0,02 | N/A | N/A | N/A | 5,6 |

| G437707 | 434228 | 5719662 | 0,00 | 0,18 | 0,03 | N/A | N/A | N/A | 0,0 |

| G437708 | 434198 | 5719607 | 0,06 | 0,00 | 0,01 | N/A | N/A | N/A | 1 |

| G437716 | 472557 | 5734986 | 0,00 | 0,15 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437733 | 433560 | 5719568 | 0,01 | 0,01 | 0,02 | 0,00 | 0,00 | 0,01 | 1,0 |

| G437741 | 409788 | 5708115 | 0,00 | 0,12 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437768 | 410717 | 5708497 | 0,05 | 0,09 | 0,02 | 0,04 | 0,13 | 0,00 | 0,0 |

| G437769 | 410764 | 5708501 | 0,06 | 0,04 | 0,01 | 0,03 | 0,15 | 0,01 | 0,0 |

| G437774 | 433674 | 5719434 | 0,00 | 0,16 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437778 | 433433 | 5719584 | 0,19 | 0,00 | 0,01 | 0,01 | 0,00 | 0,00 | 2,4 |

| G437785 | 433335 | 5719145 | N/A | N/A | N/A | N/A | N/A | 1,84 | N/A |

| G437787 | 433403 | 5719278 | 0,08 | 0,01 | 0,01 | N/A | N/A | N/A | 1,3 |

| G437791 | 473576 | 5735035 | 0,03 | 0,00 | 0,00 | 0,00 | 0,01 | 0,03 | 1,2 |

| G437796 | 473890 | 5735320 | 0,04 | 0,02 | 0,01 | 0,01 | 0,01 | 0,03 | 2,0 |

| G437799 | 432665 | 5719344 | 0,00 | 0,17 | 0,01 | N/A | N/A | N/A | 0,5 |

| H862196 | 462278 | 5733634 | 0,01 | 0,00 | 0,00 | N/A | N/A | N/A | 1,1 |

| H862199 | 435888 | 5721637 | 0,04 | 0,01 | 0,01 | N/A | N/A | N/A | 1,1 |

| H862211 | 472580 | 5735435 | 0,00 | 0,15 | 0,01 | N/A | N/A | N/A | 0,0 |

| H862216 | 439188 | 5723121 | 0,02 | 0,00 | 0,01 | 0,00 | 0,00 | 0,00 | 1,6 |

| H862222 | 410549 | 5708717 | 0,00 | 0,15 | 0,01 | 0,01 | 0,00 | 0,00 | 0,0 |

| H862223 | 410523 | 5708720 | 0,00 | 0,23 | 0,01 | 0,00 | 0,00 | 0,00 | 0,0 |

| H862225 | 410888 | 5708761 | 0,14 | 0,01 | 0,01 | 0,00 | 0,00 | 0,11 | 0,8 |

| H862232 | 404238 | 5704280 | 0,05 | 0,02 | 0,01 | 0,00 | 0,00 | 0,01 | 1,4 |

| H862235 | 404371 | 5703731 | 0,02 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 1,4 |

| H862253 | 465555 | 5735317 | 0,01 | 0,01 | 0,01 | N/A | N/A | N/A | 1,0 |

| H862646 | 468111 | 5732492 | 0,00 | 0,10 | 0,01 | N/A | N/A | N/A | 0,0 |

| H862649 | 468280 | 5732592 | 0,27 | 0,02 | 0,01 | 0,00 | 0,03 | 0,03 | 1,2 |

| H862651 | 468280 | 5732593 | 0,02 | 0,11 | 0,01 | 0,01 | 0,01 | 0,00 | 0,0 |

| H862652 | 468176 | 5732738 | 0,03 | 0,01 | 0,01 | 0,00 | 0,00 | 0,00 | 1,1 |

| H862654 | 471169 | 5734659 | 0,00 | 0,22 | 0,01 | N/A | N/A | N/A | 0,0 |

| H862659 | 471353 | 5734785 | 0,33 | 0,02 | 0,01 | 0,01 | 0,02 | 0,00 | 0,9 |

| H862664 | 471475 | 5734851 | 0,10 | 0,04 | 0,02 | 0,00 | 0,00 | 0,02 | 0,8 |

| H862667 | 434495 | 5719723 | 0,06 | 0,01 | 0,01 | 0,00 | 0,01 | 0,01 | 1,4 |

| H862668 | 434496 | 5719724 | 2,11 | 0,59 | 0,05 | 0,02 | 0,07 | 1,83 | 35,5 |

| H862669 | 434497 | 5719725 | 1,79 | 0,17 | 0,02 | 0,01 | 0,04 | 1,35 | 26,4 |

| H862671 | 434498 | 5719725 | 5,21 | 0,79 | 0,08 | 0,01 | 0,21 | 3,35 | 50,8 |

| H862672 | 434500 | 5719726 | 0,17 | 0,28 | 0,02 | 0,02 | 0,03 | 0,06 | 3,5 |

| H862673 | 434515 | 5719783 | 0,12 | 0,06 | 0,01 | 0,01 | 0,01 | 2,19 | 5,7 |

| H862674 | 434542 | 5719802 | 0,00 | 0,15 | 0,01 | 0,02 | 0,01 | 0,01 | 0,0 |

| H862675 | 434566 | 5719784 | 0,16 | 0,05 | 0,01 | 0,08 | 0,25 | 0,05 | 0,9 |

| H862676 | 434563 | 5719786 | 0,16 | 0,01 | 0,00 | 0,00 | 0,00 | 0,16 | 0,8 |

| H862677 | 434584 | 5719868 | 0,00 | 0,14 | 0,01 | 0,00 | 0,00 | 0,00 | 0,0 |

| H862678 | 434628 | 5719865 | 5,70 | 0,02 | 0,00 | 0,01 | 0,00 | 1,17 | 24 |

| H862679 | 434631 | 5719869 | 3,69 | 0,04 | 0,01 | 0,01 | 0,01 | 0,2 | 15,6 |

| H862681 | 434643 | 5719881 | 0,22 | 0,07 | 0,01 | 0,12 | 0,47 | 0,04 | 1,1 |

| H862682 | 434656 | 5719896 | 0,21 | 0,10 | 0,02 | 0,02 | 0,06 | 0,05 | 1,0 |

| H862683 | 434658 | 5719899 | 3,12 | 0,64 | 0,02 | 0,00 | 0,02 | 0,44 | 11,3 |

| H862684 | 471449 | 5734833 | 0,30 | 0,03 | 0,02 | 0,00 | 0,00 | 0,00 | 1,5 |

| H862685 | 471451 | 5734834 | 0,24 | 0,02 | 0,02 | 0,01 | 0,00 | 0,01 | 2,9 |

| H862686 | 471447 | 5734834 | 0,97 | 0,00 | 0,00 | 0,00 | 0,00 | 0,01 | 6,8 |

| H862687 | 471461 | 5734846 | 0,11 | 0,01 | 0,01 | 0,00 | 0,00 | 0,01 | 1,2 |

| H862691 | 471488 | 5734862 | 0,30 | 0,02 | 0,01 | 0,01 | 0,00 | 0,00 | 1,4 |

| H862692 | 471486 | 5734861 | 0,22 | 0,01 | 0,00 | 0,00 | 0,01 | 0,01 | 1,4 |

| H862702 | 419311 | 5764054 | 0,00 | 0,00 | 0,00 | N/A | N/A | N/A | 6,0 |

| H862705 | 434655 | 5719881 | 0,20 | 0,04 | 0,01 | 0,15 | 0,36 | 0,03 | 1,1 |

| H862706 | 434655 | 5719895 | 2,36 | 0,04 | 0,01 | 0,01 | 0,01 | 0,57 | 13,4 |

| H862707 | 434658 | 5719900 | 3,37 | 0,53 | 0,03 | 0,01 | 0,02 | 0,59 | 14,2 |

| H862708 | 434660 | 5719898 | 0,26 | 0,50 | 0,06 | 0,39 | 1,08 | 0,13 | 1,9 |

| H862711 | 434668 | 5719890 | 1,27 | 0,82 | 0,17 | 0,02 | 0,39 | 0,71 | 7,5 |

| H862712 | 434668 | 5719889 | 0,55 | 0,04 | 0,01 | 0,02 | 0,04 | 0,12 | 2,8 |

| H862715 | 434652 | 5719889 | 0,39 | 0,05 | 0,01 | 0,09 | 0,21 | 0,07 | 1,8 |

| H862716 | 434700 | 5719930 | 0,03 | 0,13 | 0,01 | 0,01 | 0,01 | 0,02 | 0,0 |

| H862717 | 434702 | 5719932 | 0,54 | 0,07 | 0,01 | 0,00 | 0,01 | 0,15 | 3,2 |

| H862719 | 434745 | 5719949 | 0,04 | 0,04 | 0,01 | 0,07 | 0,22 | 0,03 | 0,0 |

| H862721 | 434769 | 5719973 | 0,23 | 0,12 | 0,01 | 0,20 | 0,59 | 0,05 | 0,8 |

| H862722 | 434768 | 5719974 | 0,21 | 0,10 | 0,01 | 0,17 | 0,48 | 0,04 | 0,7 |

| H862723 | 434767 | 5719975 | 0,34 | 0,13 | 0,01 | 0,29 | 0,67 | 0,07 | 1,4 |

| H862729 | 411113 | 5709014 | 0,45 | 0,08 | 0,03 | 0,19 | 0,42 | 0,03 | 2,0 |

| H862731 | 411108 | 5709006 | 0,07 | 0,02 | 0,01 | 0,00 | 0,00 | 0,01 | 1,6 |

| H862732 | 411109 | 5709008 | 0,05 | 0,01 | 0,00 | N/A | N/A | 0,011 | 1,2 |

| H862733 | 411107 | 5709008 | 0,12 | 0,07 | 0,03 | 0,15 | 0,44 | 0,03 | 2,4 |

| H862735 | 411180 | 5708993 | 0,02 | 0,11 | 0,01 | 0,04 | 0,15 | 0,00 | 0,0 |

| H862736 | 411182 | 5708980 | 0,06 | 0,04 | 0,01 | 0,03 | 0,12 | 0,00 | 0,0 |

| H862739 | 410288 | 5708275 | 0,03 | 0,03 | 0,01 | 0,08 | 0,30 | 0,00 | 0,0 |

| H862741 | 410284 | 5708273 | 0,49 | 0,38 | 0,05 | 0,06 | 0,57 | 0,02 | 1,8 |

| H862742 | 410277 | 5708268 | 0,83 | 0,14 | 0,02 | 0,01 | 0,19 | 0,01 | 2,6 |

| H862743 | 410270 | 5708263 | 0,75 | 0,04 | 0,01 | 0,33 | 0,38 | 0,01 | 2,0 |

| H862744 | 410265 | 5708258 | 1,93 | 0,07 | 0,01 | 0,08 | 0,48 | 0,02 | 3,5 |

| H862745 | 410263 | 5708255 | 0,24 | 0,28 | 0,03 | 0,06 | 0,44 | 0,01 | 1,1 |

| H862746 | 410253 | 5708240 | 0,28 | 0,16 | 0,02 | 0,03 | 0,36 | 0,01 | 1,2 |

| H862747 | 410238 | 5708232 | 0,07 | 0,03 | 0,00 | 0,06 | 0,27 | 0,00 | 0,0 |

| H862748 | 410253 | 5708265 | 0,21 | 0,32 | 0,03 | 0,05 | 0,48 | 0,01 | 0,8 |

| H862749 | 410176 | 5708247 | 0,41 | 0,01 | 0,00 | 0,01 | 0,01 | 0,08 | 2,4 |

| H862751 | 410135 | 5708218 | 0,06 | 0,01 | 0,01 | 0,00 | 0,00 | 0,04 | 1,7 |

| H862752 | 410264 | 5708253 | 1,71 | 0,62 | 0,08 | 0,02 | 0,55 | 0,02 | 4,2 |

| H862753 | 409938 | 5708125 | 0,08 | 0,43 | 0,05 | 0,04 | 0,78 | 0,02 | 0,5 |

| H862754 | 409941 | 5708120 | 0,11 | 0,11 | 0,01 | 0,17 | 0,61 | 0,01 | 0,8 |

| H862755 | 409845 | 5708244 | 0,18 | 0,22 | 0,02 | 0,03 | 0,69 | 0,01 | 0,8 |

| H862756 | 409843 | 5708242 | 0,12 | 0,30 | 0,03 | 0,03 | 0,60 | 0,01 | 0,7 |

| H862757 | 409843 | 5708243 | 0,11 | 0,27 | 0,03 | 0,02 | 0,65 | 0,01 | 0,5 |

| H862759 | 409924 | 5708160 | 0,06 | 0,15 | 0,01 | 0,05 | 0,26 | 0,00 | 1,6 |

| H862760 | 409923 | 5708161 | 0,16 | 0,39 | 0,03 | 0,16 | 0,42 | 0,01 | 4,5 |

| H862764 | 411136 | 5708972 | 0,17 | 0,09 | 0,01 | 0,04 | 0,19 | 0,00 | 0,0 |

| H862766 | 411247 | 5709037 | 0,05 | 0,04 | 0,01 | 0,10 | 0,41 | 0,00 | 0,0 |

| H862767 | 411246 | 5709040 | 0,31 | 0,14 | 0,01 | 0,22 | 0,71 | 0,00 | 0,5 |

| H862768 | 411248 | 5709041 | 0,58 | 0,02 | 0,00 | 0,00 | 0,30 | 0,93 | 1,6 |

| H862769 | 411273 | 5709055 | 0,09 | 0,04 | 0,01 | 0,18 | 0,20 | 0,01 | 0,0 |

| H862776 | 434498 | 5719725 | 4,09 | 0,21 | 0,03 | 0,01 | 0,15 | 4,96 | >100 |

| H862782 | 434305 | 5719638 | 0,02 | 0,15 | 0,01 | 0,11 | 0,06 | 0,01 | 0,0 |

| H862783 | 434508 | 5719740 | 0,09 | 0,03 | 0,01 | 0,08 | 0,19 | 0,01 | 0,7 |

| H862791 | 473033 | 5735619 | 0,17 | 0,08 | 0,02 | 0,00 | 0,01 | 0,01 | 1,1 |

| H862795 | 431884 | 5718866 | 0,17 | 0,77 | 0,07 | 0,07 | 0,52 | 0,01 | 1,1 |

| H862796 | 431882 | 5718866 | 0,06 | 0,29 | 0,03 | 0,10 | 0,54 | 0,01 | 6,3 |

| H862797 | 431880 | 5718865 | 0,06 | 0,22 | 0,03 | 0,22 | 0,51 | 0,01 | 7,1 |

| H862620 | 410524 | 5708220 | 0,06 | 0,01 | 0,01 | 0,00 | 0,00 | 0,01 | 1,0 |

| H862621 | 410487 | 5708334 | 0,14 | 0,06 | 0,01 | 0,03 | 0,09 | 0,01 | 0,0 |

| H862623 | 410509 | 5708726 | 0,00 | 0,24 | 0,01 | 0,00 | 0,00 | 0,00 | 0,0 |

| H862625 | 410751 | 5708484 | 0,01 | 0,13 | 0,01 | 0,01 | 0,01 | 0,01 | 0,0 |

* Value already released, see press release September 11, 2025

Grab samples are selective by nature, unlikely to represent average grades, and may not represent true underlying mineralization.

Table 2: Best 2025 Previous Samples Cu-Ni-Co-Pt-Pd-Au-Ag Results

| Previous results Sample # | Easting UTM | Northing UTM | Cu % | Ni % | Co % | Pt g/t | Pd g/t | Au g/t | Ag g/t |

|---|---|---|---|---|---|---|---|---|---|

| G437035 | 451867 | 5722962 | 0,03 | 0,01 | 0,01 | 0,00 | 0,00 | 0,01 | 1,8 |

| G437036 | 451873 | 5722974 | 0,02 | 0,01 | 0,01 | 0,00 | 0,00 | 0,02 | 1,6 |

| G437039 | 451853 | 5723202 | 0,02 | 0,01 | 0,00 | 0,00 | 0,00 | 0,02 | 1,6 |

| G437044 | 451720 | 5722952 | 0,00 | 0,00 | 0,00 | 0,00 | 0,00 | 0,01 | 1,0 |

| G437045 | 451720 | 5722951 | 0,01 | 0,00 | 0,00 | 0,00 | 0,00 | 0,01 | 2,9 |

| G437046 | 451721 | 5722952 | 0,02 | 0,02 | 0,00 | 0,01 | 0,02 | 0,04 | 2,5 |

| G437054 | 451770 | 5722743 | 0,04 | 0,03 | 0,03 | 0,01 | 0,01 | 0,02 | 6,3 |

| G437059 | 451640 | 5722663 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 0,01 | 1,4 |

| G437064 | 451373 | 5721840 | 0,17 | 0,01 | 0,00 | 0,00 | 0,00 | 0,01 | 0,9 |

| G437083 | 468938 | 5738920 | 0,13 | 0,03 | 0,01 | 0,00 | 0,00 | 0,02 | 0,9 |

| G437091 | 430749 | 5718153 | 0,01 | 0,01 | 0,03 | 0,01 | 0,02 | 0,00 | 2,6 |

| G437093 | 430711 | 5718487 | 0,00 | 0,12 | 0,01 | 0,00 | 0,00 | 0,00 | 0,0 |

| G437094 | 430177 | 5718546 | 0,01 | 0,11 | 0,01 | 0,02 | 0,01 | 0,00 | 0,0 |

| G437095 | 427701 | 5716748 | 0,03 | 0,01 | 0,01 | 0,00 | 0,00 | 0,00 | 2,1 |

| G437102 | 427614 | 5716632 | 0,07 | 0,01 | 0,01 | 0,00 | 0,00 | 0,01 | 1,3 |

| G437152 | 408972 | 5707811 | 0,01 | 0,06 | 0,01 | 0,04 | 0,15 | 0,00 | 0,0 |

| G437153 | 408968 | 5707806 | 0,01 | 0,08 | 0,01 | 0,04 | 0,17 | 0,00 | 0,0 |

| G437155 | 408971 | 5707823 | 0,01 | 0,11 | 0,01 | 0,00 | 0,00 | 0,00 | 0,0 |

| G437157 | 408968 | 5707838 | 0,04 | 0,31 | 0,02 | 0,07 | 0,29 | 0,00 | 0,0 |

| G437158 | 408909 | 5707800 | 0,01 | 0,14 | 0,01 | 0,03 | 0,10 | 0,00 | 0,0 |

| G437159 | 408905 | 5707718 | 0,10 | 0,07 | 0,01 | 0,03 | 0,17 | 0,00 | 0,0 |

| G437165 | 408870 | 5707692 | 0,07 | 0,31 | 0,03 | 0,05 | 0,16 | 0,00 | 0,0 |

| G437166 | 408712 | 5707578 | 0,00 | 0,13 | 0,01 | 0,01 | 0,01 | 0,00 | 0,0 |

| G437200 | 416837 | 5711736 | 0,00 | 0,11 | 0,01 | 0,00 | 0,00 | 0,00 | 0,0 |

| G437203 | 419139 | 5713303 | 0,05 | 0,01 | 0,01 | N/A | N/A | 0,05 | 1,3 |

| G437205 | 419155 | 5713319 | 0,05 | 0,03 | 0,02 | N/A | N/A | 0,036 | 1,1 |

| G437226 | 467997 | 5732573 | 0,02 | 0,01 | 0,04 | 0,00 | 0,01 | 0,02 | 1,0 |

| G437227 | 468070 | 5732586 | 0,02 | 0,01 | 0,01 | 0,00 | 0,00 | 0,00 | 1,0 |

| G437230 | 468245 | 5732563 | 0,00 | 0,17 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437232 | 468197 | 5732544 | 0,00 | 0,19 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437243 | 463492 | 5726183 | 0,09 | 0,01 | 0,00 | N/A | N/A | 0,02 | 1,7 |

| G437314 | 480348 | 5741578 | 0,01 | 0,00 | 0,00 | N/A | N/A | 0,012 | 13,6 |

| G437383 | 464135 | 5727577 | 0,03 | 0,01 | 0,01 | 0,01 | 0,00 | 0,00 | 1,0 |

| G437386 | 464384 | 5727704 | 0,04 | 0,02 | 0,01 | 0,01 | 0,01 | 0,01 | 2,5 |

| G437417 | 425419 | 5709482 | 0,02 | 0,00 | 0,00 | N/A | N/A | 0,02 | 1,3 |

| G437432 | 404009 | 5705421 | 0,10 | 0,01 | 0,00 | 0,00 | 0,00 | 0,00 | 3,1 |

| G437433 | 403996 | 5705420 | 0,03 | 0,04 | 0,01 | 0,00 | 0,01 | 0,01 | 2,1 |

| G437434 | 403821 | 5705213 | 0,07 | 0,01 | 0,00 | 0,00 | 0,00 | 0,00 | 1,2 |

| G437435 | 404290 | 5705427 | 0,01 | 0,00 | 0,05 | 0,00 | 0,01 | 0,00 | 1,0 |

| G437445 | 410059 | 5708265 | 0,00 | 0,14 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437446 | 410058 | 5708293 | 0,00 | 0,18 | 0,01 | 0,00 | 0,00 | 0,01 | 0,0 |

| G437447 | 410052 | 5708326 | 0,00 | 0,17 | 0,01 | 0,00 | 0,00 | 0,00 | 0,0 |

| G437448 | 410258 | 5708248 | 0,33 | 0,76 | 0,07 | 0,03 | 0,62 | 0,01 | 1,0 |

| G437449 | 410260 | 5708252 | 0,54 | 0,14 | 0,02 | 0,06 | 0,62 | 0,03 | 1,6 |

| G437450 | 410267 | 5708262 | 0,22 | 0,12 | 0,01 | 3,38 | 0,15 | N/A | 0,0 |

| G437461 | 460598 | 5724400 | 0,01 | 0,12 | 0,01 | 0,01 | 0,01 | 0,01 | 0,0 |

| G437462 | 460596 | 5724397 | 0,00 | 0,17 | 0,01 | 0,01 | 0,00 | 0,02 | 0,0 |

| G437471 | 468943 | 5733033 | 0,00 | 0,12 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437473 | 468598 | 5732810 | 0,00 | 0,19 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437474 | 468566 | 5732786 | 0,00 | 0,25 | 0,01 | N/A | N/A | N/A | 0,0 |

| G437475 | 464199 | 5727661 | 0,05 | 0,03 | 0,01 | 0,00 | 0,01 | 0,01 | 1,2 |

| G437476 | 464172 | 5727626 | 0,06 | 0,03 | 0,02 | 0,00 | 0,00 | 0,01 | 1,7 |

| G437480 | 463535 | 5727167 | 0,01 | 0,00 | 0,00 | N/A | N/A | N/A | 1,3 |

| H862122 | 425787 | 5710097 | 0,15 | 0,04 | 0,01 | 0,00 | 0,01 | 0,02 | 1,6 |

| H862502 | 456873 | 5725150 | 0,00 | 0,13 | 0,01 | N/A | N/A | N/A | 0,0 |

| H862577 | 426170 | 5718938 | 0,03 | 0,00 | 0,00 | N/A | N/A | N/A | 1,8 |

| H862603 | 424322 | 5710333 | 0,17 | 0,00 | 0,00 | N/A | N/A | N/A | 1,2 |

Grab samples are selective by nature, unlikely to represent average grades, and may not represent true underlying mineralization.

Critical Elements’ 100%-owned Nemaska Belt properties consist of 1,052 Exclusive Exploration Rights across ten different property blocks, covering a total of 540 km2. The portfolio spans over 100 km of the Nisk structure and its associated volcano-sedimentary belt. This east-northeast-oriented belt features recognized potential for lithium-associated pegmatite dykes and copper, nickel, and PGE mineralization associated with ultramafic rocks.

Now that all the results from this surface program are received, these results and previous geophysical surveys will be incorporated to refine targeting for a planned 2026 winter drill program. This drill program will test the newly generated high-grade nickel-copper-PGE and lithium-bearing spodumene drill targets. The program will also seek to expand the mineralized footprint of the Rose West Discovery. Rose West lies within the 395 km² Rose Lithium-Tantalum and Rose South property blocks and is located less than 10 km west of the Corporation’s flagship Rose Lithium-Tantalum Project (see press release dated April 22, 2024). As a reminder, the Rose Lithium-Tantalum Project Feasibility Study published in August 2023 (see press release dated August 29, 2023) returned an after-tax NPV8% of US$2.2 billion and an after-tax IRR of 65.7%.

Management continues to be engaged in assembling the funding required to make a final investment decision on the Rose project. These efforts build on the $20 million conditional funding from Natural Resources Canada’s Critical Minerals Infrastructure Fund (see press release dated February 6, 2025) and the support letter from a leading Canadian financial institution stating its interest in providing long term debt financing of up to US$115 million (approximately C$150 million) of project debt (see press release dated February 10, 2025).

Detailed map and data are available on Critical Elements’ website at https://www.cecorp.ca/en/nemaska-belt-vtem-en-2025-11-04/ and https://www.cecorp.ca/en/map-mag-survey-nemaska-belt-with-results-en-2025-11-04/

Table 3: Selected New Lithium-Tantalum Results from Rose

| Sample # | Easting UTM | Northing UTM | Li2O % | Ta2O5 ppm |

|---|---|---|---|---|

| G437577 | 420410 | 5768917 | 0,16 | 175 |

| G437581 | 421508 | 5768496 | 1,98 | 106 |

| G437582 | 421532 | 5768492 | 0,15 | 124 |

| G437583 | 421414 | 5768512 | 1,27 | 103 |

| G437584 | 421341 | 5768428 | 1,69 | 289 |

| G437585 | 421317 | 5768440 | 1,41 | 196 |

| G437586 | 421297 | 5768471 | 1,49 | 196 |

| G437587 | 421285 | 5768470 | 0,55 | 245 |

| G437588 | 421563 | 5768319 | 0,01 | 230 |

| G437598 | 421909 | 5767451 | 2,10 | 74 |

| G437722 | 419424 | 5764495 | 1,76 | 116 |

| G437723 | 419435 | 5764492 | 0,61 | 141 |

| G437724 | 419449 | 5764478 | 0,66 | 244 |

| H862261 | 421947 | 5767408 | 1,45 | 62 |

| H862698 | 419296 | 5764083 | 2,00 | 111 |

| H862699 | 419326 | 5764051 | 1,95 | 125 |

| H862701 | 419317 | 5764053 | 1,48 | 108 |

| H862702 | 419311 | 5764054 | 0,93 | 116 |

Quality assurance/quality control

Quality assurance and quality control procedures have been implemented to ensure best practices in sampling and analysis of the samples. Standards and blanks were regularly inserted into the sample stream. The samples were delivered in secure, tagged bags to the ALS Minerals laboratory facility in Val-d’Or, Quebec. The samples are weighed and identified prior to sample preparation. Rock samples were crushed to 70% minus 2 mm, then separated and pulverized to 85% passing 75 μm. Samples were assayed for a 33-elements suite using a four-acid digestion method (ME ICP 61) with re-assay of values over 10,000 ppm for copper using a four-acid digestion and ICP finish (Cu-OG62). Gold, platinum and palladium were analyzed by fire assay with an ICP-AES finish (PGM-ICP-27). Gold was analyzed using fire assay only, when PGE mineralization was not suspected (Au-AA23). When Lithium-mineralization was identified, samples were assayed using a peroxide-fusion method (ME-MS89L). Gold values above 10 g/t were re-assayed by fire assay with a gravimetric finish (GRA-21).

Qualified Person

François Gagnon, P. Geo, Operations Director – Québec for Dahrouge Geological Consulting Ltd., is the Qualified Person who has reviewed and approved the data and technical content of this press release on behalf of the Corporation.

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly-owned, high-purity Rose Lithium-Tantalum project in Québec, the Corporation’s first lithium project to be advanced within a land portfolio of over 1,016 km2. On August 29, 2023, the Corporation announced results of a new Feasibility Study on Rose for the production of spodumene concentrate. The after-tax internal rate of return for the Project is estimated at 65.7%, with an estimated after-tax net present value of US$2.2B at an 8% discount rate. In the Corporation’s view, Québec is strategically well-positioned for US and EU markets and boasts good infrastructure including a low-cost, low-carbon power grid featuring 94% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government, received the Certificate of Authorization under the Environment Quality Act from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parks, and the project mining lease from the Québec Minister of Natural Resources and Forests under the Québec Mining Act.

For further information, please contact:

Jean-Sébastien Lavallée, P. Géo.

Chief Executive Officer

819-354-5146

www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement concerning forward-looking statements

This news release contains “forward-looking information” within the meaning of Canadian Securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “scheduled”, “anticipates”, “expects” or “does not expect”, “is expected”, “scheduled”, “targeted”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Forward-looking information contained herein include, without limitation, statements relating to the anticipated receipt of the final assay results from the 2025 summer exploration program on the Corporation’s Nemaska Belt properties, the results and completion of the 2025 exploration program and its related objectives. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Although Critical Elements has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking information include, but are not limited to: delays in obtaining final assay results from the laboratory facility, the final and complete results of the Corporation’s 2025 exploration program on the Corporation’s Nemaska Belt properties not delivering the anticipated results and the effects on the Corporation’s stated objectives, as well as those risk factors set out in the Corporation’s Management Discussion and Analysis for its most recent quarter ended May 31, 2025 and other disclosure documents available under the Corporation’s SEDAR+ profile. Forward-looking information contained herein is made as of the date of this news release and Critical Elements disclaims any obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Forward-looking information contained herein is made as of the date of this news release. Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.