This page is currently under maintenance. Please come back soon for more information.

Copper, Nickel, PGE, Gold

Property description

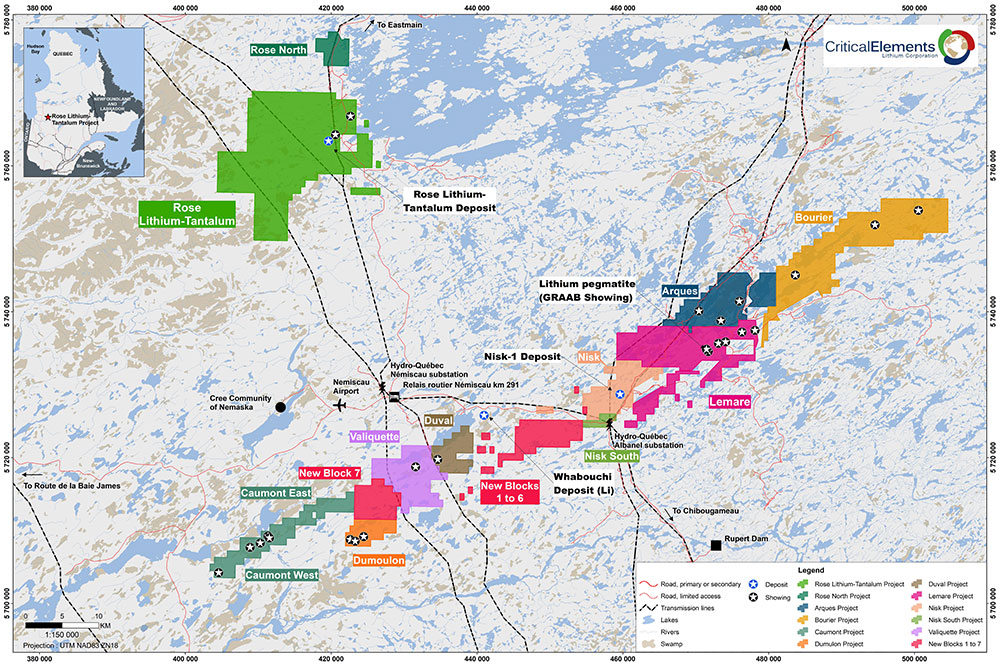

The Nisk property is composed of two blocks totaling 90 claims covering an area of 45.9 km2 and a length of over 20 km. The Route du Nord from Chibougamau runs inside the south border of the Property. Nisk-1 is also traversed in a NE direction by a Hydro-Québec power line and a road that heads north to the Eastmain River and beyond to the La Grande River area.

The Nisk project offers strong lithium potential in a well-established area. The lithium pegmatites tend to occur in swarms in the volcano-sedimentary units. The Nisk property covers a large part of the regional volcano-sedimentary unit, a favourable unit that hosts Nemaska Lithium's Wabouchi deposit and the Lemarre showing.

Located in the northeastern part of the Superior geological province, and more specifically in the northeastern part of the Lac des Montagnes Formation, the Lac des Montagnes volcano-sedimentary belt is a sequence of aluminous metasediments and amphibolites containing basalts and ultramafic sills.

These rocks are highly sheared and cut by 20% late granitoids (leucogranite and biotite pegmatite).

Geology

The Lac des Montagnes volcano-sedimentary formation crosses the property in a NE direction. The geology covered by the property is mainly composed of biotite, sillimanite, staurotide and garnet-bearing gneisses and granites, pegmatites, amphibolites and ultramafic intrusive rocks. Geophysical surveys show the signature and extent of ultramafic intrusions, some of which have been historically confirmed by drilling. The North of the Lac des Montagnes formation is mainly composed by orthogneisses intruded by granites, while the South area of this formation is composed principally of paragneisses, also intruded by granites.

Mineralization

The property is currently known for its magmatic nickel-copper sulphide deposits associated with ultramafic intrusion potential. It notably holds the Nisk-1 Ni-Cu-PGE deposit.

Nisk-1 Ni-Cu-PGE deposit

The Nisk-1 deposit is located at UTM coordinates 459,950 mE / 5,728,500 mN. It is hosted in an elongated body of serpentinized ultramafic rocks that intrude the Lac des Montagnes paragneiss and amphibolite sequence. The ultramafic rock intrusion is a sill bordered by paragneisses and amphibolites. Quite similar on either side of the ultramafic sill, they still can be subdivided into a lower paragneiss sequence ("LPS") to the NW of the sill (stratigraphically older) and an upper paragneiss sequence ("UPS") to the SE of the sill (stratigraphically younger).

The ultramafic sill is not a single intrusion. At least two distinct lithological units can be identified. The first, a grey serpentinized peridotite with magnetite veinlets, does not contain any sulphide minerals. The second is a black serpentinized peridotite with chrysotile veinlets. The Ni-Cu-Co-Fe sulphide mineralization is invariably associated with this black serpentinite.

In summary and on average, the sequence intersected by drilling, (striking N164°E with a 50° to 70° plunge to the SE) in the ultramafic body is as follows: (i) 35 meters of unmineralized grey serpentinite; (ii) 4 meters of unmineralized black serpentinite; (iii) 12 meters of massive to disseminated sulphides in black serpentinite; and (iv) 27 meters of unmineralized black serpentinite, sometimes alternating with the grey serpentinite, also unmineralized.

The Nisk-1 deposit is the only mineralized zone with estimated resources on the property.

Technical Report

Recent Development

On December 22, 2020, the Company signed an agreement with Chilean Metals Inc. (“Chilean”) to option up to 80% of the Nisk nickel-copper-PGE project (the “Property” or "Nisk-1"), in Quebec’s Eeyou Istchee James Bay territory in Quebec.

Option Terms

Grant of first option

The Company grants to Chilean the exclusive right and option to acquire, on or before the date that is three (3) years from the TSX.V approval, an initial 50% Earned Interest in the Property. In order to acquire this interest, Chilean must:

- (a) make cash payments totalling $500,000 to the Company on or before the dates set out below:

- (i) a non-refundable amount of $25,000 on the date of execution of the agreement (condition fulfilled);

- (ii) an amount of $225,000 within a delay of five (5) Business Days following the Effective Date; and

- (iii) an amount $250,000 within a delay of six (6) months from the Effective Date.

- (b) Issue to the Company within a delay of five (5) Business Days following the Effective Date, 12,051,770 Shares of Chilean.

- (c) incur an aggregate of $2,800,000 of Work Expenditures on the Property on or before the dates set out below:

- (i) $500,000 in Work Expenditures on or before the date that is one (1) year from Effective Date;

- (ii) $800,000 in Work Expenditures on or before the date that is two (2) years from Effective Date; and

- (iii) $1,500,000 in Work Expenditures on or before the date that is three (3) years from Effective Date.

Grant of second option

Subject to Chilean having exercised the First Option, the Company hereby also grants to the Optionee the exclusive right and option to increase its Earned Interest in and to the Property from 50% to 80% by incurring or funding additional Work Expenditures for an amount of $2,200,000, including the delivery of a Resource Estimate, for a period commencing on the delivery of the First Option Exercise Notice and ending on the date that is four (4) years from Effective Date.

Following the exercise of the Second Option, until such time as a definitive Feasibility Study regarding extraction and production activities on the Property is delivered to the Joint Venture, Critical Elements shall maintain a 20% non-dilutive interest in the Joint Venture and shall not contribute to any Joint Venture costs.

Operatorship

During the currency of the Agreement, except as otherwise contemplated under the Agreement, Chilean shall act as the operator and shall be responsible for carrying out and administering the Work Expenditures on the Property. Chilean shall be entitled to receive a management fee equal to 10% of the amount of Work Expenditures incurred on internal work and equal to 5% of the amount of Work Expenditures incurred on contract work carried by third party contractors or consultants.

Royalty

Following the exercise of the First Option by Chilean, and in addition to the obligations of Chilean under the First and Second Option, if applicable, Critical Elements shall receive, in the event of a Lithium discovery, a royalty equal to 2% net smelter returns resulting from the extraction and production of Lithium products, including Lithium ore, concentrate and chemical, resulting from the extraction and production activities on the Property, including transformation into chemical products. Chilean shall have the right at any time to purchase 50% of the Royalty and thereby reduce the Royalty to 1% by paying to Critical Elements a total cash amount of $2,000,000.

Lithium Marketing Rights

In the event of a Lithium discovery, Critical Elements will retain Lithium Marketing Rights meaning the exclusive right of Critical Elements to market and act as selling agent for any and all Lithium products, including Lithium ore, concentrate and chemical, resulting from the extraction and production activities on the Property, including transformation into chemical products.